7 of the Best Money-Making Apps of 2023

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

For those looking to make money in an easily accessible way, apps provide plenty of avenues to consider. You can use your smartphone to take surveys, pick up a side gig, sell your unwanted stuff and more.

Here’s the scoop on seven free money-making apps. NerdWallet considered apps with at least four stars and 25,000 reviews in both Google Play and the iOS App Store.

7 of the best apps to make money

- Still deciding on the right carrier? Compare Medicare Part D Plans

- What's next?

- Conventional mortgage

- VA loans

- FHA loans

- USDA loans

- LOOKING TO SAVE ON INTEREST?

- What you can do

- Key takeaways

- More NerdWallet resources for non-citizens

- Get details on Medicare coverage for:

- How do we review brokers?

- How do we review cryptocurrency platforms?

- How to complete the FAFSA if:

- Business insurance ratings methodology

- This offer has expired.

- Key takeaways:

- NERDUP BY NERDWALLET

- Key takeaways about ChexSystems:

- Bookkeeping and accounting software

- Key takeaways about FDIC insurance

- 3.4

- 5.0

- Still deciding on the right carrier? Compare Medigap plans

- Still deciding on the right carrier? Compare Medicare Advantage plans

- Bank of America CD rates 2023

- Ally CD rates

- Capital One 360 CD rates

- Using more sustainable materials to make the cards

- Social Security number

- Potential dangers of credit

- Donating to specific causes

- Credit's positive impact

- Income

- Offering carbon offsets

- Downsides to debit

- Date of birth

- How to get started

- Security questions

- Where debit shines

- Contact information

- A promise to tell the truth

- Agreement to terms and conditions

- Authorized users

- How to maximize your rewards

- Key takeaways

- About Overstock

- At a glance

- Quick summary of IRA rules

- Chase Sapphire lounge locations in the U.S.

- Does home insurance cover AC units?

- Still deciding on the right carrier? Compare Medigap plans

- Still deciding on the right carrier? Compare Medicare Advantage plans

- Fidelity CD rates

- Lock your card

- Cut off access to cash advances

- Seek help from a mental health professional

- Freeze your credit

- Place a fraud alert on your credit report

- Put bills on autopay

- File a report with the Federal Trade Commission

- File a police report

- Freeze your credit

- Be persistent about removing fraudulent charges

- Work with a credit counselor

- Block fraudulent debt from your credit report

- Flip your script

- Student loan payment calculator

- Hub access to a variety of destinations

- What it really means to diversify

- 1. Mobile broadband

- Environmental

- Key takeaways for CD investing

- 65% of a company’s business comes from existing customers

- 1. You don’t have to attend every party

- Find a cheaper credit card processor

- May: Memorial Day

- 1. Your bank or credit union

- What is an FHA Title 1 loan?

- Rewards checking basics

- Nearest airports

- Who is eligible to contribute to a Roth IRA?

- No-penalty CDs

- Application processing is slow

- More ways to use the home equity line of credit calculator

- 1. Inpatient hospital care

- Score the sizeable welcome offer

- Finding your state’s bill of sale form

- Voice: $4.99 per month

- What you need to know

- Step 1: Apply for unemployment benefits

- 1. AmEx has a "once per lifetime" welcome offer rule

- 1. Start saving early

- Winner for flight options: American for domestic travel, United for international

- 1. Set a budget and make a shopping list

- Highlights

- Banks

- 1. The welcome offer

- Winner for the number of destinations served: Emirates

- 1. Amazon

- 1. Getting started: The 50/30/20 budget

- Sale events

- Credit score

- In this article

- 1. Abuelo’s

- How and where mobile keys work

- What is 100% credit utilization?

- 1. American Airlines may not owe you anything

- 1. You may not be entitled to anything

- Search lots of booking sites

- Create a Cash App account

- The welcome offer and earn rates

- 1. Attractive welcome bonus

- First: Standard airport security and departure formalities

- 1. Check online community marketplaces

- 1. Do you stay at a particular hotel chain?

- Tactic 1: Get a credit card with a TSA PreCheck credit

- Keep an eye out for your marriage certificate

- Best for: Real-time price comparisons

- 1. There are multiple tiers of Emerald Club status

- Burst pipes

- For sailings across the Caribbean, Mexico or Central America: CheapCaribbean

- 1. Holding the card won’t cost you anything

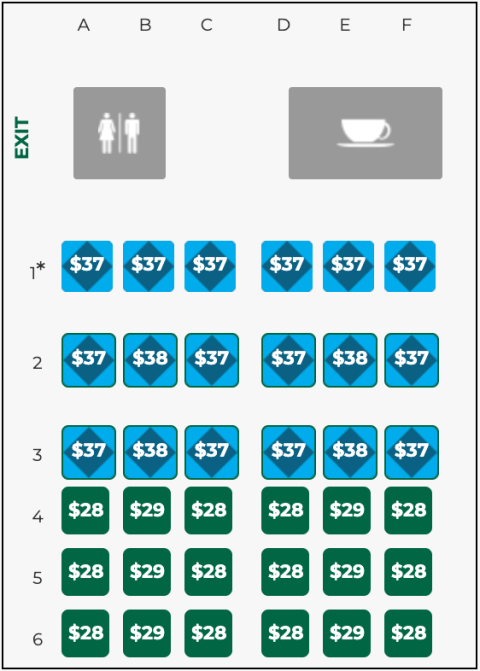

- Seats

- Winner for the number of destinations served: Qatar

- 1. Ask for time to consider the offer

- Fixed or adjustable rate?

- 1. Sell your gently-used clothes to a thrift store

- Variable expenses definition

- Compare lease buyout options

- What should my credit score be to buy a house?

- Paying as easy as texting

- Fiverr

- 1. Come to your workplace

- 1. Decide between an online broker or a robo-advisor

- Rethink gift-giving

- 1. Pick an investment account

- 1. It’s free

- Baggage allowance on Qatar

- Are you affected?

- Short-term goal examples:

- You can save a lot of money as a Priceline VIP

- American Airlines has several hubs

- Cheapest: OFX

- 1. Earn the welcome bonus

- 1. Join the AAdvantage loyalty program to earn rewards

- Figure out your 'fun' budget

- Online will-writing software

- 1. Checks

- Winner: Hilton

- 1. Delay your application

- IRS customer service hours

- 1. Earn with ads as a YouTube Partner Program member

- 1. Pull your credit

- CD rates

- Step 1. Include the date

- How to use this calculator

- FHA home loans

- 1. Startup and organizational costs

- Long-term fuel savings

- Pros

- Original Medicare

- 1. ThredUP

- Does American Airlines charge to change flights?

- Refinance to a lower interest rate

- 1. Your credit score

- Income-based repayment calculator for existing plans

- GA income tax rates: Single filers

- Come to terms with risk

- Foreign transaction fees

- Member deals and 1% earnings on purchases

- Winner for most flight options: Delta

- 1. Think about your investment accounts

- California speeding ticket fees

- Winner for most options: Lufthansa

- Social

- 1. Fly Delta

- What property is tax deductible?

- Winner: British Airways

- Be Relax Spa

- 1. Don't give in to pressure to pay on first contact

- With seats

- Customers spend 43% more money at brands they’re loyal to

- Save on the interest you pay

- 1. Le Méridien Maldives Resort & Spa

- Personal loans

- Safepal: Most currencies

- 1. Report the loss or theft to U.S. authorities

- Insurer complaints methodology

- 1. When to sell stocks

- Airline reward redemptions: award charts vs. dynamic pricing

- Tell your insurer when other drivers are involved

- 1. It offers a $300 annual travel credit

- 2. Your employer or 401(k) provider

- Defining a 30-year fixed-rate mortgage

- 1. You’re excluded from meetings

- Requesting an IRS tax transcript online

- 1. Check the airline's luggage requirements

- Domestic travel with an adult

- Standard CDs

- GasBuddy

- 1. Elite status levels are rewarding from the moment you sign-up

- How to book a Maldives honeymoon with points and miles

- It's borrowed money

- The welcome offer

- 1. Choose a bakery format

- Real estate agent commissions

- 1. Invest in your 401(k) and get the matching dollars

- 1. Japan Airlines

- Direct mail

- 1. Choose how to apply

- 1. Home-based or easily accessible

- Regulations and taxes

- Nearest airports

- 1. Where to find them

- 1. You still owe your debts …

- Build your credit score

- 1. Miraval Austin Resort & Spa, Austin, Texas

- Program highlights

- 1. Pack light

- Eligibility

- How does Rover work?

- Smart contracts

- 1. Decide how much investing help you want

- Get pre-approval for car purchase financing

- 1. Create an inventory

- In this article:

- 1. Cash in flexible travel rewards points

- Highlights

- Earning Delta Platinum Medallion status

- How does my credit score impact personal loan offers?

- 1. 'Let us help you to apply for the employee retention tax credit'

- Coinsurance

- Individual: $10.99 per month

- Why you should care

- Pay your credit card bill in full every month

- Even More Space upgrades

- Welcome bonus

- 1. A generous sign-up bonus

- Pay more than minimum

- 1. Morningstar

- To invest in stocks you couldn’t otherwise afford

- National, regional and community banks

- Step 1: Write a business plan

- Eligibility

- Get in touch ASAP

- Term life insurance

- You can pay less in interest

- 1. Make sure everyone is OK

- Star Alliance membership

- Nerd tip

- Pros

- 2. Auntie Anne’s

- Funding fee for purchase loans or construction loans

- Step 1: Choose your niche

- SIPC coverage provides ...

- Medicare initial enrollment period

- 1. A 401(k) or other employer retirement plan

- 1. Arrive in the right spot — and at the right time

- Loyalty program

- 1. Ask for a preparer tax identification number (PTIN)

- See if refinancing can save you money

- Methodology

- United Auto Workers (UAW)

- Go to the 'Buy Bitcoin' screen

- Why you would choose it:

- Co-signing vs. joint car loans

- During the on-ramp

- Second: U.S. preclearance formalities

- 2. Sample products

- Is the Costco Anywhere Visa® Card by Citi still worth it?

- 1. Do you always fly the same airline?

- Other factors to consider

- Know what to expect when applying to rent

- 1. Know the fees

- How does it work?

- A broker

- What does 'domicile' mean?

- Location

- London-Heathrow

- Your bank or credit union

- 1. Buy REITs (real estate investment trusts)

- Roof size — $4,350 to $11,000 per thousand square feet

- Mortgage approval: What’s behind the numbers in our DTI calculator?

- 2. Sell sought-after gear to a pawnshop

- Find preapproved offers before heading to the dealership

- 1. Home repair business

- TruckSmarter

- Highlights

- Earn ANA miles by flying

- 1. Choose your business entity

- 1. Chime

- You've got a steady income

- 1. Max out your retirement accounts

- Accommodations

- Laboratory tests

- 1. Deposit locally, transfer electronically

- Bitcoin pros

- Enhanced award availability for MileagePlus tickets

- Alliant Credit Union: Best credit union

- 33.2 million small businesses across the U.S.

- Your personal credit and experience

- Delta and Hertz status match

- Freelancer.com

- Transcontinental flights

- Personal American credit cards

- 1. Influencer

- 1. No blackout dates

- Refundable flights

- Through your card or card issuer

- Transfer the loan to your child

- Business structure

- Can provide supplemental retirement income

- Early park entrance

- 1. Southwest Airlines

- 1. Create realistic organizational processes

- 1. Choose your account type

- 1. The Second Service Foundation

- 1. Earn airline elite status

- 1. Budget discount codes

- Fraud protection

- Health care facilities and operators

- SkyTeam Lounge (International departures, D Concourse)

- Ramp Card

- Credit score

- Florida High Tech Corridor grant

- Series EE vs. Series I

- 1. It’s exhibiting outsize performance

- 1. Fairfield Anaheim Resort

- You fly with a kid 14 and younger

- Key survey findings

- How banks try to prevent in-house crime

- Step 1: Identify your niche.

- Alaska Airlines

- Buying a used car from a dealer? Find your financing offers

- IHG Rewards Club

- Boisset Rewards

- Texas Workforce Commission’s Skills for Small Business Grant Program

- 1. Ibotta

- Short-term capital gains tax

- Nearest airports

- Step 2. Name the recipient

- Before you start

- Understanding your results

- 1. Find your niche

- Is the gift tax deductible?

- Key takeaways:

- The basics: Indiegogo

- Size of the battery = size of the gas tank

- What mortgage terms are best for me?

- Save on United award flights to Europe

- Minimum income requirements for filing a tax return

- AT&T

- Category: Best credit card for college students

- A faster reservations process

- 1. People are planning more (and longer) trips

- 2. The The Platinum Card® from American Express welcome offer spending requirements

- Cost

- Cons

- Common investment and brokerage fees

- 1. Review your electric bill

- 2. Shop at the right time

- Step 1. Pick a niche

- 2023 HSA contribution limits

- 1. Set up a robust — and honest — profile

- 1. Are you exempt from withholding tax?

- 2. Curb your spending: The envelope system, or 'cash stuffing'

- Quick facts and who qualifies for a solo 401(k)

- GA income tax rates: Married filing jointly or head of household

- 1. Georgia State Small Business Credit Initiative

- Pros

- Understand the budgeting process

- Credit history

- A little something on your birthday

- 1. Understand your valuation

- 1. Your credit score and financial situation

- Standard with ads: $6.99 per month

- What’s behind the numbers in our USDA mortgage calculator

- Stay at Marriott hotels

- PIN debit

- 2. Satellite

- Airline credit cards

- Governance

- 1. Accounting and bookkeeping

- 1. Redeem miles for American flights

- Check different hotel dates before booking a flight (and vice versa)

- Astraea Lesbian Foundation for Justice

- DAF tax deductions

- Step 1: Pick an airline with lower seat selection fees

- 1. Fill out the pre-qualification form

- 1. Create educational content or activities

- 2. Annual free night certificate

- Universal Studios Orlando

- Who gets to avoid this fee:

- 1. Business-to-consumer (B2C)

- Historical Wyndham Rewards point values

- Premium Individual: $10.99 per month

- It costs 5X more to acquire a new customer than it does to retain a returning one

- Boost

- Capital One Savor Cash Rewards Credit Card*

- Group employee health insurance

- 1. High rewards rate on multiple spending categories

- Appliance leaks

- Business profiles and listings

- Step 1: Write a business plan

- How do wealth managers get paid?

- Oil stocks

- 1. Annual fees are optional — but sometimes worthwhile

- SBA loans

- Credit card surcharging

- World of Hyatt Credit Card

- What can business owners use SSNs for?

- Next: Best overall insurance provider for sole proprietors

- Our picks for authorized user card spending limits

- Decide on an account type

- July: Independence Day

- Renewable Energy Systems & Energy Improvement Grants

- SIMPLE IRA vs. traditional IRA

- App features

- Average monthly expenses for one person:

- In the app

- 1. You alone are responsible for paying

- Winner for hotel availability: Hilton

- Carnival cruise destinations

- 3. Your online broker

- How to qualify for rewards checking

- Major airlines flying to Houston

- When can you no longer contribute to a Roth IRA?

- American Express® Gold Card

- Air travelers

- Savings accounts

- 1. Miles never expire

- General partners vs. limited partners

- Lower credit scores

- Online lenders

- When can I use Park Hoper?

- How business term loans work

- Highlights

- Location

- What traditional banks offer

- 1. Solid ongoing rewards rates and welcome offers

- 1. Southwest’s change fee policy is still the best

- 1. LivePlan

- Other factors to consider

- Free 24-hour cancellation

- Personal United credit cards

- 1. Space-available room upgrades

- Our pick for: Cash back / paying off debt

- Our pick for: Grocery spending, commuting and streaming service subscriptions

- Benefits at InterContinental Hotels & Resorts

- Personal Southwest credit cards

- 1. Conforming conventional loans

- 2. Gather your identification

- 2. Flexible hours

- Full-service shoppers: Shop (or pick up) and deliver when you want

- Our pick for: General pet care and supplies

- Tennessee industries

- 1. Decide whether to invest in BNB

- Online

- Winner: Delta

- 2. … but you might make your payments to someone else

- How to invest money

- Hands-on or hands-off investing?

- Earning points

- Large-cap biotech stocks

- Eligibility

- You can save even more by using the Priceline app

- 1. Child or elder care

- Easy redemption but fewer perks

- Step 1: Write your business plan

- You could receive a lower rate

- Airbnb properties don't have full-time staff to address issues

- Early repayment fees

- Use the right flight booking tools

- Star Alliance

- If you decide to cancel your United flight within 24 hours of booking

- Orbitz rewards

- Wingstop franchise sales

- IRS phone numbers

- 1. Pick up freelance work online

- Why buy used?

- APR ranges for online lenders

- Credit score

- Tax brackets 2023 (taxes due 2024)

- How do I see my credit score for free?

- Example savings APYs at select institutions

- CD terms

- The 6 standard types of home insurance coverage

- 1. Come up with a name and choose a business entity

- What to know about cash advance apps

- Copay

- Home insurance quotes online

- Pros

- 1. Start with a new or existing retirement account

- What if I'm trying to remove myself as an authorized user?

- Qualifying child

- 2. Inventory

- Simple rewards

- What happens during a shutdown

- Higher year-over-year mortgage rates

- 2. Decide how much home you can afford

- 1. Chase Ultimate Rewards®

- Invoice financing example

- Lower your interest rate

- Online lenders

- 1. E-commerce store

- Skip seat selection altogether

- New income-driven repayment plan calculator

- Capital One® Walmart Rewards™ Mastercard®

- 2. EBay

- Our pick for: Simplicity

- 1. Baskin-Robbins

- Higher earnings rate

- MileagePlus

- 1. Link the two accounts

- Avis Preferred

- Cons

- Out-of-network ATM fees

- What it looks like

- 3. Baskin-Robbins

- Medigap

- 1. Business assistance

- When do you need a passport?

- Latino: $32.99 per month

- Follow USDA food plans

- 1. A jet-setting welcome offer

- Lightning Lane

- SIPC insurance doesn’t cover ...

- What is pre-foreclosure?

- The Emirates economy class experience

- Our pick for: General wedding expenses

- California car insurance rates after a speeding ticket

- Passive vs. active management

- 1. World of Hyatt

- What doesn't count as a property tax deduction

- Do it yourself

- Higher supply

- Advertising from the 'government'

- Add purchase details and finalize

- Which hotels offer Club InterContinental access?

- Automatic Bonvoy Silver Elite status

- What investments to put where

- Student loans

- More rewarding for most spending, with a kicker

- Chance to earn an additional award night

- Stretch your food budget

- Social Security

- Card details

- Best for: Cash back on the stuff you buy

- Size

- 1. Decide how much coverage you need

- 1. Universal Orlando Resort — if you still want an Orlando vacation

- 1. Figure out if you are eligible

- Boeing 747-8

- Step 1: Find your niche.

- 2. Seek out additional information

- Goal 1. Set aside $500 to cover emergencies

- 3. Sell gold or other precious metals

- Cash-back credit cards

- Hyatt points value over time

- Waldorf Astoria Las Vegas

- 2. Freelancing

- The pros of a 30-year fixed-rate mortgage

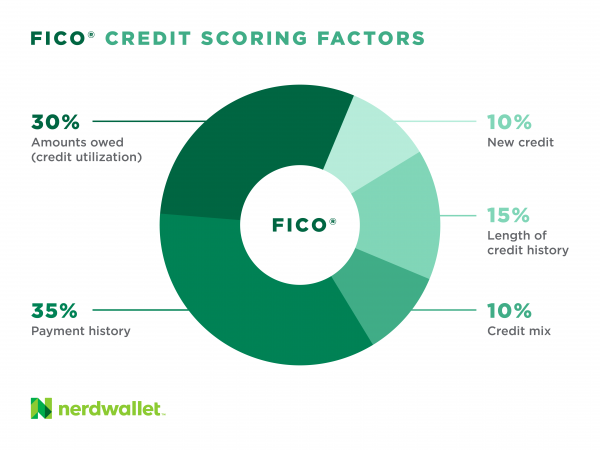

- What is a good FICO score?

- 2. You’re left off important emails

- Eligibility

- 1. Standard brokerage account

- 1. Create a wedding venue

- Driveable RVs

- Requesting an IRS tax transcript via phone

- Find data usage settings on your iPhone or Android

- Digital safety

- How to book the Axel Hotel Barcelona with points

- 10x total points on hotel stays and car rentals purchased through Chase Ultimate Rewards®

- How they started

- Classes of service

- Food and beverages

- What you'll get with the Marriott and United status match

- Erie: Best overall customer satisfaction

- First Internet Bank Business Money Market Savings

- How Escape Lounge access differs in the U.K.

- Step 1: Write a business plan

- Preapproval helps you set a realistic budget

- 1. Turo

- 1. Alaska-Canada

- If you cause the accident

- Hampton by Hilton

- Spend to the end

- Ally Bank: Best bank and best money market account

- Auto vs. manual payments

- 12.9 million jobs created

- The recommended tipping range

- How cardless ATMs work

- Forming a union

- Examples of benefits you can get with travel credit cards

- 2. Write a business plan

- It may not be valid for some travel — even if it hasn’t expired

- Changes and cancellations

- 2. Air Canada covers any cash surcharges

- 2. Harass you

- Franchise

- 2. Choose where to open your IRA

- Confirm you have direct loans, or consolidate

- Accommodates complex needs

- 2. Consider index funds

- It already has an extensive user base

- Check in baggage chart

- 1. Market your business and attract new clients

- When your credit score improves or you start to make more money

- Earning points

- 2. Register your account

- Contribution limits

- Maturity

- 1. Figure out what type of business you want to buy

- Fastest (tie): Xoom

- 2. Enroll for Priority Pass lounge access

- VA loans

- Estimate travel costs

- Differences in block size, transaction speed

- You don’t always fly solo

- How to get (and pay for) TSA PreCheck

- Long-term capital gains tax

- 1. Nordstrom

- Who needs life insurance?

- Major airlines flying into Honolulu

- Step 3. Fill in the amount with numerals

- 1. It applies only to investments held in taxable accounts

- Lower transaction fees than Etsy

- In the process

- Benefits of the on-ramp

- Use your results to save money

- Representatives and service advisors

- Insurable interest

- 1. EBay: Vast marketplace teeming with cell phone sellers

- Dependent income requirements for filing a tax return

- 1. Gather your information

- Boost

- Earn maximum points for regular spending

- Writing a bill of sale for a car

- Student: $5.99 per month

- Ability to skip the line when you drop off your car

- Holiday Inn Express

- Why is NVIDIA stock up more than 200% this year?

- 2. Bonus earnings on travel, dining, select streaming services and online grocery purchases

- Debt snowball

- Credit limits, and how you use them, matter

- NY state income tax: Single and married filing separately

- The benefits of not transferring points

- Details

- Investment, commercial and retail banks

- Sole proprietorship taxes for LLCs

- Chick-fil-A pros

- Get ready to sell

- Electric bill

- Child tax credit 2023 (taxes filed in 2024)

- Whole life insurance

- You can lower your monthly payment

- Online lenders

- 2. The bonus points

- 1. Decide what kind of marijuana business to start

- How to play Powerball

- GA income tax rates: Married filing separately

- 2. Exchange contact info

- Robo-advisors

- Cons

- Pros

- Medicare Part B IRMAA

- What to know about secured loans

- Debit card fraud

- 1. Decide how you want to invest in the stock market

- Challenge it

- Offers from partnering brands

- Add new offerings

- 1. Set financial goals

- 1. Donate to a qualifying organization

- 3. Fixed wireless

- Duty-free? Maybe not

- Refinance your car

- 2. Require a CPA, law license or enrolled agent designation

- Banks

- What’s the difference between MPI, PMI and MIP?

- Opt for a less expensive car

- 1. Restaurants

- 1. Cryptocurrency exchanges

- 2. Offer virtual team-building

- 1. Dividend stocks

- Universal Studios Hollywood

- With suites

- Low payments in the fixed-rate phase

- Premium Duo: $14.99 per month

- 3. Enroll in loyalty programs

- Mastercard

- Why do my FICO scores vary?

- Your travel goals

- Lowering your customer churn rate by 5% can increase your profitability by 75% or more

- 2. Do you check bags?

- What if the flight they rebooked me on doesn't work for my travel plans?

- Monthly fee

- 2. You earn credits, not points, toward free rentals

- Additional living expense coverage

- Earn Qmiles by flying

- Look at sectors hit hardest during the sell-off

- Repayment choices are simpler

- Atlas America

- Oil mutual funds

- An ETF

- 2. The card has a worthwhile earning structure

- Bank loans

- Our pick for: A low interest rate

- 183-day rule

- A stronger borrower profile = better rates

- Food and drinks menu

- When can I start filing taxes?

- For those age 21 and older

- Benefits when flying Oneworld airlines, broken down by tier

- SIMPLE IRA vs. 401(k)

- Average monthly expenses for a family of 2:

- On the website

- 1. You live or work outside the U.S.

- PSLF and TEACH Grants

- Tell your insurer when serious car damage or injuries could be lurking

- 10 cities and metropolitan areas with the highest concentration of electrician jobs:

- The insurer issues the death benefit in installments

- T-Mobile

- 2. DataBricks

- You have solid plans for the immediate future

- Check how long the initial HELOC rate lasts

- 1. Know what you owe and how much you can pay

- Amount of Roth IRA contributions you can make

- 1. Sign up (if your employer hasn’t done it for you)

- Blue Cash Everyday® Card from American Express

- Construction-to-permanent loans

- Pros & Cons

- 10 cities and metropolitan areas with the highest concentration of airline pilot, copilots and flight engineer jobs

- Your skin tone must look natural

- Make a 20% down payment

- How much interest could you save?

- Bitcoin cons

- Travel perks

- Eligibility

- Features

- SBA 7(a) loans

- 10 cities and metropolitan areas with the highest concentration of esthetician jobs:

- 1. Calculate an ideal budget for your household income

- 1. Avoid monthly maintenance fees

- Business United credit cards

- 1. A big sign-up bonus

- 1. Narrow your search

- International and select Hawaii flights

- Examples of travel card rental car insurance

- The best Disney World hotels for families

- Southwest business credit cards

- Welcome offer

- 2. Nonconforming conventional loans

- 3. Provide contact details

- 3. Low financial investment

- Stocks

- In-store shoppers: Shop on an assigned shift

- Through 'Click to Pay'

- Changing workforce

- Give in other ways

- Switch repayment plans

- Personal guarantee

- Rewards

- Basic economy

- From a broker or a bank

- You’re able to use all the credits

- 3. Your credit score will fall

- 2. Immediate benefits

- Location

- Focus on interest rates, save money

- Personal Cards

- Delta SkyMiles® Gold American Express Card

- 2. United Airlines

- Long-term goal examples:

- 2. Learn to be okay with outsourcing

- Earn miles and elite status when flying partner airlines

- 2. Warrior Rising

- 2. Fly with someone who has airline elite status

- Card longevity

- Compare private student loans

- What are the requirements for Rover?

- You can find great deals at boutique hotels

- Earn by flying

- Where to find Etsy coupons

- Award redemptions begin at 7,500 miles for domestic tickets

- You don’t have to leave your house

- Prospera small-business grants

- If you decide to cancel your Spirit flight within 24 hours of booking

- Exceptions to the 10% penalty

- Fundamental analysis of stocks

- CHFA highlights and eligibility requirements

- Major airlines flying to Puerto Vallarta

- Estate planning lawyers

- For groceries and gas

- U.S. Treasury bonds

- Food-centric rewards and perks

- Coppola Crush on You Rewards

- To save money on annual fees

- Center for Women Entrepreneurs StartHER Grant

- How to calculate your personal saving rate

- 2. Work longer

- If you're younger than 59½ and the account is less than 5 years old

- CA state income tax rates: Single or married filing separately

- Earning Delta Diamond Medallion status

- Child tax credit 2023 (taxes filed in 2024)

- Inventory and order management

- 2. Review your finances

- Deductible

- The basics: Kickstarter

- USDA home loans

- Energy efficiency and energy costs

- Cons

- The basics

- JetBlue Mint upgrades

- 1. Food tech

- 2. Finviz

- Pros

- To build a diversified portfolio

- Lower your monthly payments

- The pros of Roth IRAs

- Does American Airlines refund flights?

- 1. Gather your documents.

- Welcome bonus

- Follow the standard repayment plan

- 2. Social media marketing

- Ally Bank Wire Transfer Fees

- 1. Making math errors

- Minimum down payments and credit scores

- 2. Provide external account information

- Income

- 1. Do chores and odd jobs around the house or neighborhood

- Know how much risk you’re comfortable with

- ATM surcharge

- Why we like it

- How to use Apple Pay

- 4. Benihana

- Wear casual clothes

- Pro: $74.99 per month

- Reserve a longer stay

- Our pick for: Minimalists

- 2. The annual fee

- Standard: $15.49 per month

- How safe are mobile keys?

- Step 2: Write a business plan

- 2. Your credit card can reimburse you

- Pros & Cons

- 2. United can offer multiple types of compensation

- Signature debit

- Target-date funds

- Crypto trading fees

- Restaurant Business Development Program

- Lower capital gains taxes

- 1. Food trucks

- 2. Business-to-business (B2B)

- Why your personal saving rate matters

- Blue Cash Preferred® Card from American Express

- Our pick for: Introductory offers and rewards

- Silkair

- 2. Domes Miramare, a Luxury Collection Resort, Corfu

- Type

- Step 1: Assess your strengths and skill set

- 2. Use the right credit card

- PMI for conventional mortgages

- Cost of Clear membership for United and Delta members

- Pros and cons of financing a swimming pool with a personal loan

- 1. Connect your accounts

- 1. Give your money a goal

- How to get an SSN

- Amenities

- Chubb: Best general liability insurance for sole proprietors

- Lower annual fee

- A local Coinstar location

- Robo-advisor fees and account minimums

- Positive Rent Payment pilot program

- 4. Sell your spare change

- Big three prepaid plans

- How many PlusPoints are needed to upgrade United flights

- How it works

- 4. Pro-bono financial planning services

- Amazon Business Prime American Express Card

- Transportation Management Group

- 3. You stop getting new assignments

- 1. The credit card's interest rates

- A bonus offer comes standard

- Delta SkyMiles® Platinum American Express Card

- 2. Buy a money order

- Overland travelers

- Pros of covered calls

- 2. Earn and redeem with partners

- Liability protections

- Alternative minimum tax 2023

- Hilton Garden Inn

- Unlimited product listings

- Capital One 360: Best online banking experience

- 20% of new businesses close within a year

- Taxes and neighborhood fees

- 2. Use a robo-advisor

- 2. All Nippon Airways

- For the web version:

- 3. The option to book in cash + points

- Text messaging

- Realtor vs. real estate agent

- International vacation packages

- Can be used to pay off an existing mortgage

- Major airlines flying to Miami

- Create a business budget

- Recent upgrades could lead to better performance

- By staying at Hilton properties

- Redeeming points

- When does home insurance not cover your AC unit?

- When the break-even point matches your plans

- 3. Set account preferences

- 2. Shop at local grocery stores

- Labor and material costs are at massive highs

- Biotechnology and pharmaceuticals

- Interest payments

- Choose a business entity

- 2. Errand service

- Ethereum

- Choosing a card based on your spending

- Hyatt Place

- 2. Book basic economy fare tickets for the lowest rate

- General liability insurance

- 2. Gift cards

- FHA refinance loans

- You fly at least three times a year with Frontier

- FIFO

- Paying, or not, for tax preparation

- Earning points

- Who has to personally guarantee an SBA loan?

- If you purchased a United basic economy ticket

- 1. Money market accounts

- World of Hyatt

- Franchising examples

- LTV and auto loan approval

- Analysis: Benefit changes

- Wingstop franchise growth

- Debt-to-income ratio

- 2. Costco

- Do brick-and-mortar stores need an additional business license to sell online?

- Tuesdays and Wednesdays are the cheapest days to fly domestically

- But what about 529 Plans?

- Monthly after-tax income

- 2. "Get a large refund by creating your own W-2"

- CD safety

- Dwelling coverage

- If any of these situations apply to you

- Step 4. Write out the amount in words

- What is the difference between FICO score and VantageScore?

- 2. It’s not as financially fruitful if you’re in a low tax bracket

- After submitting your application

- Drawbacks of the on-ramp

- Find auto loan offers

- 2. Skilled nursing facility care

- How much should I save each month?

- 1. Know when to start retirement planning

- More perks and rewards toward travel

- 2. Amazon: Lots of pre-owned phones with Prime shipping

- Tax brackets 2023 (taxes due 2024)

- Verizon

- Family: $16.99 per month

- Our pick for: Intro APR

- Types of employee stock options

- Access to deals and rewards

- Consolidate debt with a balance transfer credit card

- Step 2: Contact your banks and lenders

- Debt avalanche

- 3. Check and polish your credit

- NY state income tax: Married filing jointly or qualifying widow(er)

- Use the free look period

- Achieving the Dream

- Securities-based line of credit example

- UTMA or UGMA vs. 529 or Coverdell ESA

- Step 2. Write your business plan

- Front-end ratio

- PayPal

- 2. How to use American Express Membership Rewards

- 2024 HSA contribution limits

- 1. Make some adjustments to your current budget

- 3. Bonanza

- SBA loans

- 1. The home wasn’t your principal residence

- Cons

- Retirement benefits

- Worldstock Fair Trade

- Get the facts

- Disney’s Hollywood Studios rides

- The value of Hilton points over time

- A community connection

- Fare flexibility/ticket changes

- Personal health and wellness services

- Funding fee for VA cash-out refinances

- 2. Explore low-cost investments

- Executive summary

- Genie+

- What happens if you miss the initial enrollment period?

- How to calculate risk tolerance

- Be patient

- 2. A robo-advisor

- Types of mutual funds for passive investing

- 1. Honeydue

- Accident-free or 'good driver' discount

- Hotel credit cards

- 2. Air Canada Aeroplan

- 2. Business consulting

- 1. Physical gold

- 10-night trip, peak summer travel season

- Check bundle deals

- Hire an attorney experienced with debt settlements

- Maximize your trade-in

- IHG Executive Club lounge benefits

- Executive summary or cover letter

- Proof-of-work example

- 3. Start a meal-prep business

- What about Lifetime Titanium Elite?

- After the on-ramp

- Hotel nights

- Premium Family: $16.99 per month

- Nonrefundable tax credit

- 1. Understand the tax effects

- Costco vs. Sam's

- 54% of customers would stop using a brand if they had a negative review go unaddressed

- Welcome offers

- 2. How valuable are the welcome offers?

- Wyndham Rewards

- Step 1: Choose the type of wedding business you want to start and a name

- Bonus points on other purchases

- Driver’s license, passport

- What you should know about free credit scores

- 1. Choose a rollover IRA account type

- 1. Transfer Hilton points to another person

- Flexibility

- Retirement Accounts

- Baggage allowance

- World of Hyatt Business Credit Card

- Trezor: Advanced security features

- Do you file 2022 taxes in 2023?

- 2. Apply for a replacement

- 1. Painting and sculpture

- Contact insurers as soon as possible

- Cruise during the shoulder season

- Pros

- How the debt-to-income calculation works

- Named perils vs. open perils

- Jackson Hewitt

- Average monthly expenses for a family of 3:

- Conrad Las Vegas at Resorts World

- 2. You might boost their credit

- Unpaid medical bills harm your credit

- ANA international flight award zones

- 2. It’s annual fee is lower than its competitors

- Federal student loans

- Time card applications around major purchases

- You've built up savings for a down payment

- Understand your offered rate

- Requesting an IRS tax transcript by mail

- Safety from the actual homes

- Construction-only loans

- Entertainment

- Pricing guides

- Alliant: Best for fast funding

- NBKC Business Money Market

- Chase Sapphire lounge locations in Asia

- Buying for friends, requesting money later

- Principle 1: Business entity assumption

- Supplemental group life insurance

- Funds based on company size

- Other businesses you’ve owned

- 2. Lock in strong rates

- The interest rate is sky high

- 2. Bonus rewards on travel and dining

- Review of your finances

- Standard 7(a) loans

- Delta basic economy baggage rules

- Short-term capital gains tax rates

- 2. Instagram manager or consultant

- Fly with United at least once a year

- 4. Select a single or joint account

- Nonrefundable flights

- Through Google Chrome

- Places you’ll see the Sonesta name

- Remember tax benefits

- Think like your customer

- 2. Hilton Rose Hall Resort & Spa, Montego Bay, Jamaica

- Boarding

- Small-cap biotech stocks

- Consider a cost-of-living rider

- Closing Cost Assistance Grant

- 3. Ask an elite member for their unused upgrades

- 529 savings plans

- Card upgrades

- Distributions

- Event and travel fees will be more transparent

- Booking Alaska flights with American miles

- 3. Use your $300 worth of annual statement credits on restaurant spending

- There are more options available

- Sign-up bonus

- Borrowers who successfully rehabilitated their loans

- Mortgage type

- Rates

- Mortgage lender’s requirements

- 2. It’s showing signs of “style drift”

- Discount points

- Direct subsidized and unsubsidized loan limits

- SkyTeam

- How insider theft still happens

- Step 2: Write a business plan.

- Domaine Serene Winery Membership Rewards

- Free checked bags

- NC Home Advantage Mortgage

- Interest on a mortgage for your main home

- Married filing jointly or qualifying widow(er)

- Coverage amounts

- Your own customizable website

- Are you experiencing financial hardship?

- 2. Write a business plan

- 1. Inspect the check

- Other student loan calculators

- Technician training and experience

- 2. Get a life coach certification

- Premium

- Captive insurance agents

- Option 1: Check your EIN confirmation letter

- Government money market funds

- Turn your points into miles for higher redemption values

- Potentially lower maintenance costs

- What happens next

- Home equity loans

- 2. Remote work enables more travel opportunities

- 3. The The Platinum Card® from American Express annual fee of $695 is higher than average

- Cons

- Chick-fil-A cons

- 1. Get your business basics in order

- Step 2: Find the store or location you want to buy or rent

- 2. Get a transcript if you need one.

- Child tax credit 2024 (taxes filed in 2025)

- 1. Figure out your gross income

- You can pay your loan off earlier

- Step 1: Enter your personal information

- Bank of America Wire Transfer Fees

- 2. Failing to report some income

- 2. Write your business plan

- 2. Did you receive income that isn't taxable?

- 3. Build up your savings: Pay yourself first

- 2. Auntie Anne’s

- 2. ACE small business loans

- Devalued miles

- 3. Confirm the new account

- Joint life insurance policies for couples

- 1. Use Choice points to book expensive destinations

- Portfolio rebalancing strategies

- 2. Babysit, walk dogs and feed pets for pay

- The Chase Freedom Flex℠ offers rotating 5% bonus categories

- Currency conversion fees

- 5. Bojangles

- Optimize your existing market

- 2. Brand recognition

- Petal® 2 "Cash Back, No Fees" Visa® Credit Card

- Elite: $84.99 per month

- When to exercise your ISOs

- 2. Big travel rewards

- How to use the USDA mortgage calculator

- Winner: Cabo

- Opendoor locations

- Step 1: Inspect your current policy

- Airline fees

- 4. Dial-up

- Other funds

- 2. Hold Delta elite status when you fly

- Hot wallet

- Relief that costs money

- New York City

- Reduced estate tax

- 2. Hybrid bar/coffee shop

- 2. Traditional stockbrokers

- 3. Airline transfers

- Flexibility

- Mortgages

- Get on an IRS payment plan

- 4. Use your library card

- Visa

- Lots of availability

- What factors affect your FICO score?

- A big annual fee has you reaching for the barf bag

- Booking

- 1. The minimum investment required

- 2. Access to My Wells Fargo Deals

- Lower your debt-to-income ratio

- Silverkris

- Materials and hardware

- If you withdraw the money early

- Extended replacement cost coverage

- More income is sheltered

- Website optimization tips

- Boeing 747-400

- Oil futures

- For reviews from other cruisers: Cruise Critic

- Directly from the U.S. government

- Online business loans

- What else should business owners know about SSNs?

- Regional retailers

- 2. Use an online real estate investing platform

- Materials — $4.25 to $39.70 per square foot

- September: Labor Day

- Prices could rise even faster

- If you're less than 30 days late

- What else to know about it

- 1. Stashed cash

- Carnival cruise prices

- A two-fund portfolio

- 5. Financial advisor consultations

- Picking up your rental car

- 3. Reselling items online

- Requirements for an FHA Title 1 Loan

- What is a good VantageScore?

- Minnesota Housing highlights and eligibility requirements

- 4. Your work is reassigned

- More about buying through TrueCar

- Flying to Houston on points and miles

- The death benefit becomes part of your estate

- The Platinum Card® from American Express

- 2. Grow hops for local breweries

- 2. Let a robo-advisor do the work

- Our pick for: Chime users

- Income taxes for single-member LLCs

- Take action

- Roth IRA rules for withdrawals

- Domestic travel as an unaccompanied minor

- Why do airlines charge them?

- Pros

- It can lead to higher balances

- Over-the-counter at-home COVID tests

- Upside

- Pay a higher interest rate

- Selling a home to an iBuyer

- You can still use the Companion Pass when booking with points

- Good deals on appealing products make sales worth a look

- Find a car loan

- Improves cash flow

- If someone else causes the accident

- Charles Schwab: Best for ATM access

- How business lines of credit work

- Support

- SBA 504 loans

- Landlord associations

- Discover Bank, 4.35% APY, no minimum opening deposit

- Property for your laundromat

- 2. Inventory all household expenses

- Refundable tickets

- When to tip your hotel housekeeper

- Security is the motivation

- If the goal is a smaller monthly payment: How long will I remain in the home?

- Key takeaways

- Etsy

- Scholarships and grants

- For the mobile app version:

- 3. Fixed-rate conventional loans

- SALT deduction for income taxes

- 3. Arrest you for debt

- Social media

- Domestic vacation packages

- Job training programs

- Business credit history

- Offers powerful free tools

- 2. Find a place to buy BNB

- By phone

- Premium economy

- Dallas-Fort Worth International Airport (DFW)

- 1. Pinpoint your goal

- To use as an emergency fund

- Who gets relief under the Sweet v. Cardona settlement?

- 1. Open an investment account

- 3. Update your business plan

- 3. Southern California Job Creators Grant

- Car rental coverage

- 3. Pack snacks

- 2. Association and corporate discounts

- Stanley Park Taphouse (Domestic, B Concourse)

- Loan-to-value ratio

- You can stack discounts to “triple dip” on savings

- Earn by spending on credit cards

- Fastest (tie): MoneyGram

- Lowest premiums: Geico

- Hyatt Regency

- 1. Physical silver

- For other Spirit flights

- Where to find your Frontier Airlines flight credits

- Corporate bonds

- 1. Book Korean Air flights using Skypass miles

- LTV and interest rates

- 2. Redeem rewards for Airbnb gift cards or cash back

- Online personal loan

- Visit your local IRS office

- If you're younger than 59½ and the account is at least 5 years old

- Cash reserves

- 3. Target

- 2023 tax brackets: single filers

- Will pre-qualifying affect my credit score?

- How collision insurance works when the other driver is at fault

- Shipping

- 50% of your income: needs

- Step 5. Say what it's for

- How do you calculate interest on a savings account?

- Step 1. Open the initial CDs

- Get pre-approved financing for new or used cars

- 3. Swappa: Solid marketplace for anyone looking to buy or sell

- World of Hyatt

- 3. Utilities

- Holiday Inn

- Automate

- With credit, older is better

- 2. Web design

- 3. Yahoo Finance

- NY state income tax: Head of household

- The benefits of transferring points

- Qualifications

- Create a budget

- Lower your loan-to-value ratio

- 2. Poshmark

- What fees do Chase checking accounts have?

- Third-party payment processor

- Back-end ratio

- Parent PLUS loan consolidation

- Compare personal loans

- 3. Freelance graphic design

- How to play Mega Millions

- Online financial planning services

- Simple redemption options

- Avis Preferred Plus

- Your industry

- 1. Research and choose your franchise

- Club O Rewards

- Debt-to-income ratio

- Know your rights

- Decide on your 401(k) investments

- Circle Week

- Baggage and boarding

- Wear a dark shirt for your passport photo

- Merchants may pass interchange savings along to shoppers — or not

- Use the 50/30/20 rule to budget for groceries

- 3. Whether you qualify for the welcome bonus

- Funding fee for Interest Rate Reduction Refinance Loans

- Premium: $19.99 per month

- What are the different types of foreclosures?

- 2. Check in

- 2. Firstly

- Fare flexibility/ticket changes

- How much does a surgical abortion cost?

- General travel cards

- 3. Air France/KLM Flying Blue

- Turn to a hardship program

- Industry

- Pros

- Seven-night trip, shoulder season

- 3. Look for friends in high places

- Where to get windstorm insurance

- Lower demand

- 1. Understand all of your options

- Find a co-signer

- David Bohnett Foundation

- Business overview

- No foreign transaction fees

- 4. Create a food waste solution

- 2. Dividend index funds and exchange-traded funds

- Mutual funds vs. index funds and exchange-traded funds

- Who gets to avoid this fee:

- Pro tip: Don’t forget the rules

- Interest

- Refundable tax credit

- 2. Don't just uproot your life

- Public Service Loan Forgiveness

- Cash flow from operations

- 88% of consumers share their negative brand experiences

- 3. What's your credit score?

- Zelle tax 2022

- UltraFICO

- 1. Chase Sapphire Reserve®

- Useful reward categories

- Serious saving while shopping

- Other factors to consider

- Why it keeps winning

- Best for: Weekly ad circulars in one digital place

- 3. JW Marriott Phu Quoc Emerald Bay Resort & Spa

- Transaction limits

- 1. Open an investment account

- Earn by spending on transfer partners’ credit cards

- Look at large companies with big drops

- Free vs. paid plans

- Overflowing toilets, bathtubs and sinks

- Conventional or government-backed?

- Food and drink servers

- 2. Decide what type of investor you are

- What does life insurance not cover?

- Pro: No monthly payment or interest

- ETFs, index funds and mutual funds

- 1. Grants.gov

- Invesco Solar ETF (TAN)

- Cash discounting

- 2. Select PayPal at checkout

- When are taxes due in 2023?

- 3. Negotiate the offer

- Thimble: Best for temporary coverage

- 2. Greeting cards

- H&R Block

- Choose the right broker

- Incentivize your fitness resolutions

- Easy-to-use credits

- Goal 2. Contribute to your 401(k)

- WHEDA highlights and eligibility requirements

- 2. Decide on an order type

- Average monthly expenses for a family of 4:

- 1. Guarantees future insurability

- Partner flight award zones

- A flat rate on all purchases

- Cons

- Is a rewards checking account worth it?

- Create reminders

- 3. Discord

- Towable RVs

- Fly United and Star Alliance

- Personal loan vs. auto loan rates

- 2. Choose an account type

- 2. Pack essentials in your carry-on

- 10x total points on Chase Dining purchases through Chase Ultimate Rewards®

- SBA microlenders

- By water

- Cons of covered calls

- Consider all the costs of buying a second home

- What is a prepaid debit card?

- Grants

- Step 2: Grow your network

- Buy an income stream

- Inventory management

- What online banks offer

- $25.7 billion in SBA 7(a) loans were provided to small businesses

- Delta and Sixt status match

- 3. 50% more value when redeeming for travel

- 2. Access to Hilton Executive Lounges

- An annual dining credit at restaurants worldwide

- 3. Singapore Airlines

- Complete Coverage

- Expedited processing fees will eat into your vacation budget

- 4. Family sharing

- Dealership

- Building coverage

- 5. Accept the terms and conditions

- Difference between a real estate agent and a broker

- Document that your employer qualifies

- Postpone payments

- The trick to finding off-peak rates at Marriott properties

- Flying to Miami on points and miles

- Updating a damaged part of your home

- Learn from your competitors

- 3. Stay invested with the "Buy and hold" strategy

- 4. You have options

- 3. It has an award chart

- Watch the calendar

- Seats

- Do you need equipment breakdown coverage for your AC unit?

- Delta SkyMiles® Platinum American Express Card

- 1. Know what you own — and why

- When you have at least 20% equity in your home

- 1. Decide how much help you want

- Redeeming points

- Mid-term goal examples:

- Receive reciprocal benefits on partner airlines

- How much does Rover pay?

- Food prices

- 2. Search for businesses that are for sale

- How to use coupons

- Multiple ways to earn miles

- It’s easy to compare vehicles

- USDA loans

- Enterprise Florida trade grants

- Technical analysis of stocks

- 2. Holiday Inn Express & Suites: Anaheim Resort Area

- Personal loans

- Flying to Puerto Vallarta on points and miles

- American Airlines

- How to earn Medallion Qualifying Dollars

- Hilton Honors

- Theme parks

- Wingstop franchise commitment

- Texas State Trade Expansion Program

- 3. Earn more

- 2. Rakuten

- Head of household

- Step 1: Find a gold ETF

- 3. Calculate your monthly payments

- Flying to Honolulu on points and miles

- 3. 'We recalculated your tax refund and you need to fill out this form'

- Travel benefits and protections

- 2. Buy-and-hold investing

- Equity of at least 15% to 20%

- Sign-up bonus

- What’s good debt?

- To get the most out of your investment

- Term life insurance policy? Stop paying

- 2. Evaluate your sunlight exposure

- 3. Use the proper forms.

- Don’t reach out over email

- Collect and keep track of your payments

- Wholesale clubs

- 2. Find your adjusted gross income

- You can tap the equity in your car

- 3. The rewards redemption opportunities

- Chase Wire Transfer Fees

- Pick an airline with lower seat fees

- 2. Choose a membership plan

- 1. Complete the education requirement

- 4 reasons to try a stock simulator

- 4. Make the most of every dollar: The zero-based budget

- Guaranteed status

- 2. You owned the home for fewer than two years

- What is a prepaid debit card?

- Cheaper prices compared to 2022

- Credit card fraud

- Advantages of a lady bird deed

- Changes and cancellations

- Carefully craft your listing

- 6. Chick-fil-A

- Personal concierge services

- Amazon term loans and Amazon Community Lending

- Claim a niche market

- Premier: $94.99 per month

- Personal loans from online lenders

- Unlimited movie and TV streaming

- Safety ratings

- Search for another banking service

- Investment goals

- Pros

- 3. Marketing services

- Funding and minimums

- 2. Gold stocks

- Online lenders

- ARM caps

- Don’t forget about vacation rentals

- Hire a debt relief company

- 1. Apple juice runs through your veins

- Why you might choose it:

- A legacy of giving

- 3. Liquor store

- 2. Undergo a soft credit check

- 2. Car wash services

- With studios

- Rate and payment caps

- 3. Consumer-to-consumer (C2C) or peer-to-peer (P2P)

- Premium Student: $5.99 per month

- Ask for an offer in compromise

- 5. Take online surveys

- Introductory 0% APR period

- Longer stays

- Adding authorized users won't cost anything

- 2. You don’t have to dress like Beyonce

- OK, what's next?

- Optional coverage

- World of Hyatt

- You need complete flexibility in your traveling

- Average Student Loan Amounts by Debt Type

- Affordable Care Act exchanges

- Automatic elite status

- Financial services providers

- Krisflyer Gold Lounge

- Resident status rules

- 3. Book first or business class

- Annual pet insurance deductible

- FHA mortgage insurance premium

- Accident and illness plan

- Step 2: Write a business plan.

- 2. Bonvoy points are more valuable at some hotels than at others

- 3. There’s no minimum amount to redeem for cash back

- Leveraged buyout

- Home equity loans

- Develop a realistic budget

- 1. To give to charity the wise way

- For those under 21

- Paying with coins

- Book a repositioning cruise to save more

- 1. Decide how much coverage you need

- Free services

- Higher interest rates and bank failures

- 1. Know if you're a target for catalytic converter theft

- Farmers Market Promotion Program

- 5. Walk a dog or feed a pet while your neighbor is away

- Cons

- 2. You make frequent transactions to or with people abroad.

- If you're more than 30 days late

- Buffets

- Lower commitment, traditionally lower rates

- When there is no need to file a car insurance claim

- The standard deduction

- 1. Start with a budget

- The cons of a 30-year fixed-rate mortgage

- Amazon Lending

- 5. You’re getting a cold shoulder from your boss

- HFA Preferred (Lo MI)

- Cheapest life insurance companies for preferred applicants

- Consider a fixed rate vs. a variable rate

- 1. Are you a fiduciary?

- 1. Open an options trading account

- What H&R Block Free can do

- Consolidate high-interest debt

- Renovation loans

- Child care

- 3. Deposit cash in a linked ATM

- Compare with similar providers

- Use products with no or low sun protection factor (SPF)

- The Hartford: Best for construction-industry expertise

- Get an 80-10-10 loan

- TD Bank Small Business Premium Money Market Account

- The payout goes directly to your beneficiaries

- LLLP vs. LP

- Late fees and a higher interest rate

- Alternative minimum tax 2024

- 2. The Bahamas

- Chase: Best for sign-up bonuses and for branch access (tie)

- MyHome Assistance Program

- Enables growth

- Tenant screening services

- Step 1: Find a China ETF

- Varo, 3.00% APY, $0.01 minimum opening deposit

- Other factors to consider

- 3. Find a household budget template

- Property appraisal and title search

- 3. Open or contribute to an IRA

- Highlights

- Restrictions

- 7(a) small loans and Express loans

- How much does this plan cost, and what does it include? Are there any additional fees?

- 1. Reconcile your account

- Other ways to access M Club lounges

- Telemarketing or telesales

- Cruises

- Through an app

- There's room to grow

- Citi Flex Pay Option

- Proceeds are tax-free

- John F. Kennedy International Airport (JFK)

- 1. Are you working?

- It’s not cheap to use

- More flexibility when booking two one-way awards

- Invest in a Roth IRA

- Business cards

- How to get Iberia Avios

- 3. American Airlines

- 4. Add inventory

- An opportunity for higher profits

- A gentle reminder

- Medical equipment

- What’s the problem with rental junk fees?

- 3. College consulting

- 2. Choose an investing account

- 4. Use the $100 property credit at St. Regis or Ritz-Carlton

- Student loan rehabilitation calculator

- Commercial property insurance

- You could get out of debt faster

- Risk

- Hertz perks

- Why earning American Airlines miles with Bank Bank may be a great option

- 3. It’s time for you to rebalance

- CHFA Mortgage Programs

- Average cost

- Oneworld

- LTV and down payment amount

- You want to add authorized users

- Traditional IRA income limits for 2023 and 2024

- Roth IRA income limits for 2023 and 2024

- 2. Test websites and apps

- Interest on a mortgage for your second home

- APR ranges for bank lenders

- Documentation

- 4. Kohl’s

- Medical requirements

- What you can do: Set a financial goal or priority if you haven’t yet

- Seller’s permit or vendor’s license

- EveryDollar

- What do I need to pre-qualify for a personal loan?

- Saturday and Monday flights can help you avoid the Sunday rush

- 1. Calculate the car payment you can afford

- Step 6. Sign your name

- Why are my FICO and VantageScore credit scores different?

- 3. If you're going for it, you have only until Dec. 31

- Integrations with other online shopping platforms

- 3. Navigate licensing, permits and taxes

- Out-of-pocket maximum

- Campaign rules: Indiegogo

- 2. Figure out how much money you need to retire

- MPG and MPGe

- Multiple beneficiaries

- It’s not what you can borrow, it’s what you can afford

- 4. Gazelle: One of the original reputable cell phone resellers

- 2. Choose the right liability car insurance coverage levels

- 5-star plans

- 4. Insurance

- Subsidies and other incentives

- Home equity line of credit (HELOC)

- 1. Secured major credit cards

- Annual fee

- Is NVIDIA valued properly?

- 3. 10% point bonus each year

- Moving average crossings

- 2. U.S. Bank rewards

- Build an emergency fund

- Get ready to buy

- Medicare Advantage

- Does Chase have a free checking account?

- DTI ratio examples

- Step 2: Account for multiple jobs

- 3. Are you exempt from minimum wage and overtime rules?

- Business term loans

- Debt-to-income ratios

- Other taxes

- Welcome offer

- Know your options

- Figuring out eligible spending

- 3. Sell your stuff in person or online

- Disney’s Hollywood Studios shows

- Available riders and add-ons

- 3. Lower failure rate

- 1. Consider your vending machine options

- How to exercise your ISOs

- 2. Track your money

- 1. Research the pay

- 3. Consider diversifying your assets

- Verizon Fios Business

- Compare with similar providers

- 2. Document your charitable contributions

- 3. Delayed flights to or from the European Union may entitle you to cash

- 3. Zeta Money Manager

- Baggage and boarding

- Defensive driver discount

- For infrequent travelers: Loyalty benefits before reaching elite status

- 1. Consider replacing pros

- Individual stocks and bonds

- 1. Equipment: $10,000 to $125,000

- Cons

- 2. Redeem American Airlines miles on partners

- 20% off in-flight purchases

- 1. Open a brokerage account

- Pre-qualifying for a personal loan

- Delay your purchase

- Owner investment

- Step 2: Skip seat selection if you have to pay

- 3. Bitcoin ATMs

- Gameway (Gaming lounge)

- 5. Capitalize on plant-based foods

- 2. Gather the facts

- 4. Private islands

- Basic company information

- Universal Orlando Resort

- Car loans

- Digital card 'assistants'

- The rule of 25 and 4% rule

- Partially refundable tax credit

- 71% of customers are unlikely to buy from a business that loses their trust

- 4. Do you pay in full?

- 3. What benefits and rewards are included?

- 2. The capital gains taxes you’ll pay

- Medical expense deduction

- Avoid owing more than your car is worth

- Disneyland Resort

- REIT types by investment holdings

- Professional installation

- 2. Choose your investments

- Fixed or adjustable rate?

- 2. Pool Hilton points with another person

- Airbus A380

- The details

- 2023 tax brackets: married, filing jointly

- Be realistic about how much you can make

- Friday is a busy travel day, period

- Where JAL flies in the U.S.

- What happens if you don't file your taxes?

- 1. 529 plans are state-sponsored, but you can pick a plan from any state

- 3. Candles

- London-Gatwick

- Pros:

- If you determine the debt is yours

- Other structures coverage

- October-December: Black Friday

- H&R Block

- Average monthly expenses for a family of 5 or more:

- Tropicana Las Vegas, a DoubleTree by Hilton hotel

- Winner for best hotel credit card: Hilton

- Tally your variable expenses

- 4. Bookkeeping, accounting, or financial planning

- Private student loans

- App features

- Buying on margin

- Minimum income or assets

- You're ready to take ownership

- Other perks for Hyatt members on Lindblad Expeditions

- Spend on United co-branded credit cards

- Check out more from Discover

- Safety from other people

- How to book Blue Chairs Resort by the Sea using points

- Federal Student Aid office

- Making reservations

- American Express® Green Card

- How to qualify for the necessary Marriott and United elite tiers

- PenFed: Best for co-sign and joint loan options

- Costs

- 3. Free changes on most domestic tickets

- Trip cancellation and interruption protection

- Points earned through Rapid Rewards credit card welcome offers count toward reaching that Companion Pass

- United States

- Car loan preapproval can save you money at the dealership

- Fast access to capital

- Hampton by Hilton

- Is the card a good fit for your friend?

- In-store pickup and delivery options

- Making payments fun with emojis

- SBA disaster loans

- Principle 2: Monetary unit assumption

- Another interest-saving tactic

- Resident status rules

- Industry or sector funds

- Pros

- The business you want to buy

- Nonrefundable tickets

- Cash is king

- If the goal is to pay less interest: Are the long-term savings worth the bigger payment?

- Credit might not be accepted

- Joining a union

- Title insurance for the buyer

- 4. Delta Air Lines

- Accident-only coverage

- Whole Pet

- Payment plans

- For economy awards

- Earning miles

- Boost the value of your Ultimate Rewards® points

- Use TSA Precheck or Global Entry

- 4. Adjustable-rate conventional loans

- 4. Pursue you for debt you don’t owe

- Table service

- Bonds

- By email

- Which Marriott hotels are changing to Sonestas?

- Pricing

- 3. Hyatt Ziva Los Cabos, Mexico

- 2. Research commodity ETFs

- 4. Refresh your marketing plan

- Book flights on partner airlines with miles

- 4. Feed the Soul Foundation's Restaurant Business Development Program

- 4. Volunteer for an oversold flight

- Brex Card

- Choose a business name

- Stablecoins

- Credit requirements

- 2. Silver stocks

- 3. Book American Airlines deals

- Make the trip fit your budget

- Dive deep to compare fares

- 1. Account for all possessions

- Expiration dates

- 3. Online peer-to-peer payments

- You hate being nickeled and dimed

- Can I inspect the interior and exterior of the car?

- Pay with cash

- Hotels.com rewards

- 2. Online high-yield savings accounts

- 2. Account for your family's needs

- 1. Pick an off-peak date

- Jordan Estate Rewards

- How to get (and pay for) Global Entry

- Other Delta perks

- Chase 2022 bonus categories

- Try calling the Taxpayer Advocate Service

- If you’re 59½ or older and the account is less than 5 years old

- Cheapest auto insurance from the largest companies

- How to thrift the smart way

- 1. Contributions can be withdrawn at any time

- Types of transfers allowed

- Step 2: Analyze the ETF

- 2023 tax brackets: married, filing jointly

- Collision insurance vs. comprehensive insurance vs. full coverage insurance

- Integrations with other online shopping platforms

- 4. "Let us help you sign up for an IRS account

- CD opening deposit

- Other structures coverage

- Crypto.com DeFi Wallet: 4.6 out of 5 stars

- If you qualify for a hardship withdrawal

- Pros of sole proprietorship

- APY calculator: Determining annual percentage yield

- Autolist

- VA home loans

- Independent insurance agents and brokers

- A debt-to-income ratio below 50%

- Resident status rules

- Category: Best all-purpose travel rewards credit card

- 4. Explore mortgage options

- 3. Extended reality

- 4. TradingView

- What’s bad debt?

- 1. Domestic American Airlines awards from 6,000 miles

- Invoice factoring example

- Avoid being upside down on your loan

- Credit unions

- Step 3: Get funding

- Water bill

- Storefronts

- 4. Consider a payment plan if you can't afford your tax bill.

- Bypass setting up a trust

- Step 1: Fund your cleaning business

- Needs

- 4. Freelance writing

- Wells Fargo Wire Transfer Fees

- 2. Calculate your annual retirement spending

- 2. Pass the exam

- Reduce the monthly payment

- When the statement balance and current balance are the same

- My relocation

- GET MORE MILES, MORE BENEFITS WITH A DELTA CARD

- 3. You didn’t live in the house for at least two years in the five-year period before you sold it

- 4. Set up external electronic transfers

- For groceries and commuting: the Blue Cash Preferred® Card from American Express

- What it looks like

- Pay it off — but beware of resurrecting zombie debt

- Question: "What are some of the best investments for a young person who wants to start saving for retirement?"

- 7. Chili’s

- Winner for most valuable airline credit card: Tie

- Move into new markets

- How do you get a visa?

- 4. Whether you can afford the minimum spend requirements for the bonus miles offer

- 3. AmEx Offers

- Unlimited reading

- Reliability

- What is REO foreclosure?

- Automatic enrollment

- Opendoor FTC settlement

- For recently issued passports

- Step 2: Shop for better rates

- 4. Virgin Atlantic Flying Club

- Location

- 3. Gold funds

- Errors not worth disputing

- Advantages of mortgage protection insurance

- Promises that are too good to be true

- Use transferable currencies

- Seattle

- National Pride Grant for LGBTQIA+ Small Businesses

- Anonymity

- 4. Handyman or contractor

- When does Marriott update lifetime status?

- Your payments could decrease

- Fees

- Other travel

- File an appeal

- 6. Cash in on credit card rewards

- State-based forgiveness

- Annual fees

- General SBA loan requirements

- Different types of planes

- So will Zelle be taxed in 2023?

- You can’t afford to pay your balance in full every month

- How does rent reporting appear on your credit report?

- Existing reservations

- Wells Fargo Active Cash® Card

- Five World of Hyatt elite night credits

- 3. No annual fee

- Other parties worth informing

- How you can protect yourself from scams

- Part-year resident status rules

- Conventional loans

- Step 2: Figure out what your market needs

- IdentityForce pros

- 3. You’ll earn rewards faster if you take lots of very short trips.

- 2. Choose your insurance deductible

- 2. Legoland — if you’ve got kids under the age of 13

- Max out your 401(k)

- Traditional 401(k) vs. Roth 401(k)

- 1. Medical transcription services

- Step 2: Register your business, get any licenses or permits

- Changes to AAdvantage elite qualification period and membership year

- Risks and rewards of bond funds

- 5-star plans

- Seller financing

- 2. National Endowment for the Arts

- iShares Global Clean Energy ETF (ICLN)

- 2. Decide how much help you want

- Here are the current offers on Southwest consumer credit cards:

- What can business owners use EINs for?

- Scenario 1: Lump-sum purchase

- The Hartford: Best business owner’s policy for sole proprietors

- Compare money market accounts

- Automated investing vs. hands-on investing

- 3. Think about investing in rental properties

- Services that charge renters

- How to use our debt-to-income ratio calculator

- 6. Babysit a kid for a great hourly rate

- This is not your 2008 recession

- How Colonial Penn’s pricing works

- 1. U.S. (Zone 6) to Japan (Zone 1)

- 3. It gives you 10,000 miles on each card anniversary

- 2. Zero-interest credit card

- More complex — and simpler — options

- Apex Capital

- Rewards can play a role, but not the main one

- Would refinancing save you money?

- 6. You’re being micromanaged

- Project Fi

- 4. Instacart

- 3. Grow specialty grains for brewing and distilling

- Intro APR offer

- 1. Tax return transcript

- 2. Understand your options

- What it can’t do

- Be on the lookout

- It may lower the average age of your accounts

- Under 35

- Recreational amenities

- Online retailers

- Build a business website

- Prepaid debit card vs. debit card vs. credit card

- Shop more to save more

- Military member or veteran? Get a VA loan

- How to book a honeymoon in Seychelles with points and miles

- A Chase lounge in Texas (sort of)

- LLLP vs. LLP

- 7,500-mile awards on American Airlines

- Discover Bank: Best savings account

- Credit bureaus

- Bask Bank, 5.10% APY, no minimum opening deposit

- 2. If ticket prices drop, Southwest lets you rebook for the lower price

- Utilities

- 4. Monitor and adjust your spending

- 3. Use nicknames to personalize accounts

- 4. Point transfers to airlines and hotels

- Diversification